Juicebox: Funding Cycle #3 proposal

Three trends have characterized these past 30 days:

- Several projects were spun up on Juicebox, entrusting the protocol to manage their money, and the JuiceboxDAO staff to help execute their treasury decisions. Several more reached out with plans to launch soon.

- People came together to help crowdfund JuiceboxDAO alongside the fees paid by the first batch of projects. They all took on the laid-out risks and lent us their trust.

- Some very talented, caring, insightful, passionate people showed the fuck up and want to build.

It may ultimately be too early to tell, but it seems we might have not only found product market fit, we've found it across several different treasury use cases: DAOs that ship products (JuiceboxDAO, TileDAO), DAOs that collect NFTs (SharkDAO), boutique service shops (WAGMI Studios, CanuDAO), NFT galleries, and group bidding. There are still several improvements to make for each of these treasury use cases while maintaining a cohesive experience, and I see clear potential for even more diversity of ideas.

We are a little over 30 days in, this is just the beginning. I'm confident the Juicebox protocol can stretch much, much further.

Focus

As a DAO, we should consider focusing on the following areas:

-

Risk mitigation | make sure things don't go to zero. current lead: jango, exekias

-

**UX improvements **| improve and make templates for project onboarding and the project dashboard. current lead: peripheralist

-

Project support, education, & docs | make sure JB projects have the resources they need to get started and thrive. current lead: jango, natimuril, WAGMI Studios, CanuDAO

-

Analytics | give projects rich insights into their community treasury. current lead: peripheralist (, Buradorii?)

-

**Liquidity pools **| add support for JB treasury tokens in secondary markets. current lead: exekias

-

Marketplace | give JB projects a place to sell digital goods (and physical?) which pipe percentages of revenue to any number of addresses and juicebox treasuries. current lead: jango, nicholas, peripheralist

-

Governance | plan out how we will make decisions together. current lead: zheug (, unicornio?)

My proposal for FC#3:

Duration: 14 days (no change) I think we can find a nice pace with 14 day funding cycles. Let's stick with this.

Ballot: 7 day buffer (no change) A reconfiguration proposal must be submitted 7 days before the end of the current funding cycle. I think we can get the hang of having the opportunity to vote on proposals every other week, with decisions made one week prior to them taking effect. This time frame is only possible thanks to CanuDAO, who's staff is managing our communications and operations. They've done a marvelous job getting things organized and keeping everyone on the same page.

Discount rate: 10% (-6%) The discount rate should be further reduced by 6%. This is arbitrary, but it continues to give those who commit funds during FC#3 a good discounted rate to adjust for the risk of being early while continuing the process of tapering the rate off.

The goal is to reduce the rate over time as risk subsides (code risk, infrastructure risk, usability risk, organization risk, governance risk).

It pays to be early and to take the risk sooner rather than later.

Bonding curve: 60% (+-0%) No need to change this. Still arbitrary, but there's no demand to redeem right now, so might as well keep it this tight as we adjust the discount rate.

**Payouts: **$71k total (including $40k bug bounty that could be returned if unused)

I propose we raise the target to properly hire the people and projects who are already showing up and making things flow and grow, and experiment with payouts to a few up-and-coming contributors.

This also allows core contributors to embed themselves in the communities of emerging projects built with Juicebox and have cash-on-hand to support those they believe in. Actively supporting these communities is everything.

Core contributors

- **jango **| dev: $10k Lead.

- **peripheralist **| dev : $10k Peripheralist has not only built the Juicebox website and been improving it since launch, he also successfully launched TileDAO around a gorgeous art project he wrote. He's got first hand experience leading a community and business around a Juicebox treasury. There's no better dev to have on board.

- **CanuDAO **|comms:$2.5k Since CanuDAO's staff, zeugh and mvh3030, joined our community and gotten to work, everything seems to be running smoother. They keep our Discord organized, help with community onboarding, make sure everyone is heard and treated with respect, and makes sure the rest of the contributors can continue working towards what's ahead.

This payout is an investment in CanuDAO, we'll get their juicebox project's treasury tokens in return.

- **WAGMI Studios **| art, animations, and educational content: $2.5k WAGMI Studios is working towards putting out art, animations, and visual assets that strengthen and add color and character to the concepts that we're working on. This will increasingly important going forward as we reach beyond a crypto-native audience.

This payout is an investment in WAGMI Studios, we'll get their juicebox project's treasury tokens in return.

Experimental contributors

- **exekias **| dev : $3k Since Juicebox's launch, exekias has helped write infrastructure contracts for piping marketplace royalties back to Juicebox treasuries, helped with dev ops, and helped tease out complex ideas out with the rest of the team. More importantly, he launched WikiTokenDAO – he has first hand experience with dev onboarding onto Juicebox, getting a Juicebox treasury funded, and building a community around it. We want him on our team.

- nicholas | dev: $1.5k We need someone who can help us create a generalized NFT marketplace template that pipes a project's sales into Juicebox treasuries. This has emerged as a need for several projects in the ecosystem. Nicholas has been working on a product called NFTstory for the past several months and is intimately familiar with the ERC-721 standard and how it can be improved and extended. He's expressed interest in working with me to take this project on, he just might be the perfect dev for it. Let's see how things go.

- **natimuril **| project support: $500 Projects that are building on Juicebox tend to need someone to be available for questions, ideation, and support. Natimuril will start helping us out with need, and eventually take on the responsibility fully herself. If all goes well, her idea is to operationalize her process and grow a collective around this community service effort.

- Buradorii | analytics: $500 We need someone who can help form and execute queries on the treasury data that Juicebox projects are putting out, turn these into visual dashboards, and help to tell stories from the data. Buradorii has begun experimenting with running Dune analytics queries over the past week, and seems to be getting the hang of it.

Allocations

- Bug Bounty | $40k A total of $20k to pay out to whitehat hackers who report vulnerabilities. Payouts will be according to bug severity. Moe info coming soon. This payout will be returned to the treasury if unused.

- Figma, Infura, Gitbook, Mee6 & Fleek subscriptions | $500

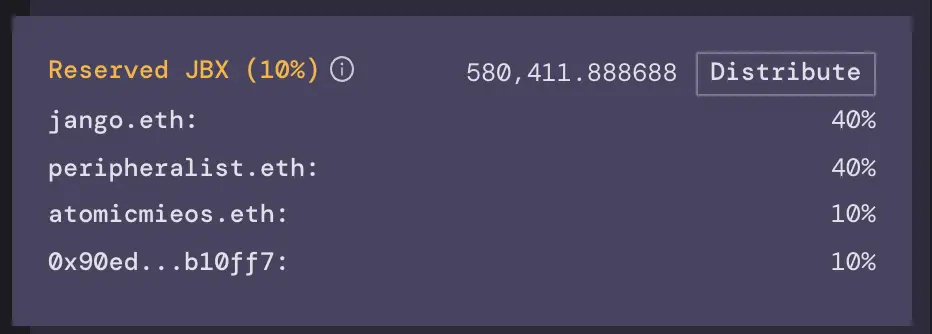

Reserved rate: 35% (+ 10%) The reserve rate should increase by 10%. We should continue to allocate 25% to core contributors, and we should add an additional 10% for ETH/JBX liquidity provider incentives.

Reserved token distribution:

- **jango: **35%

- peripheralist: 35%

- CanuDAO: 10%

- WAGMI Studios: 10%

- exekias: 7.5%

- misc: 2.5% - for on-demand incentives paid out by the multisig wallet.

There are still no guarantees for future payouts to anyone mentioned here, including myself. We'll have to come together over time to reassess allocations based on how things go, including pay increases and reserved JBX to experimental contributors who prove to be invaluable to the community over time.

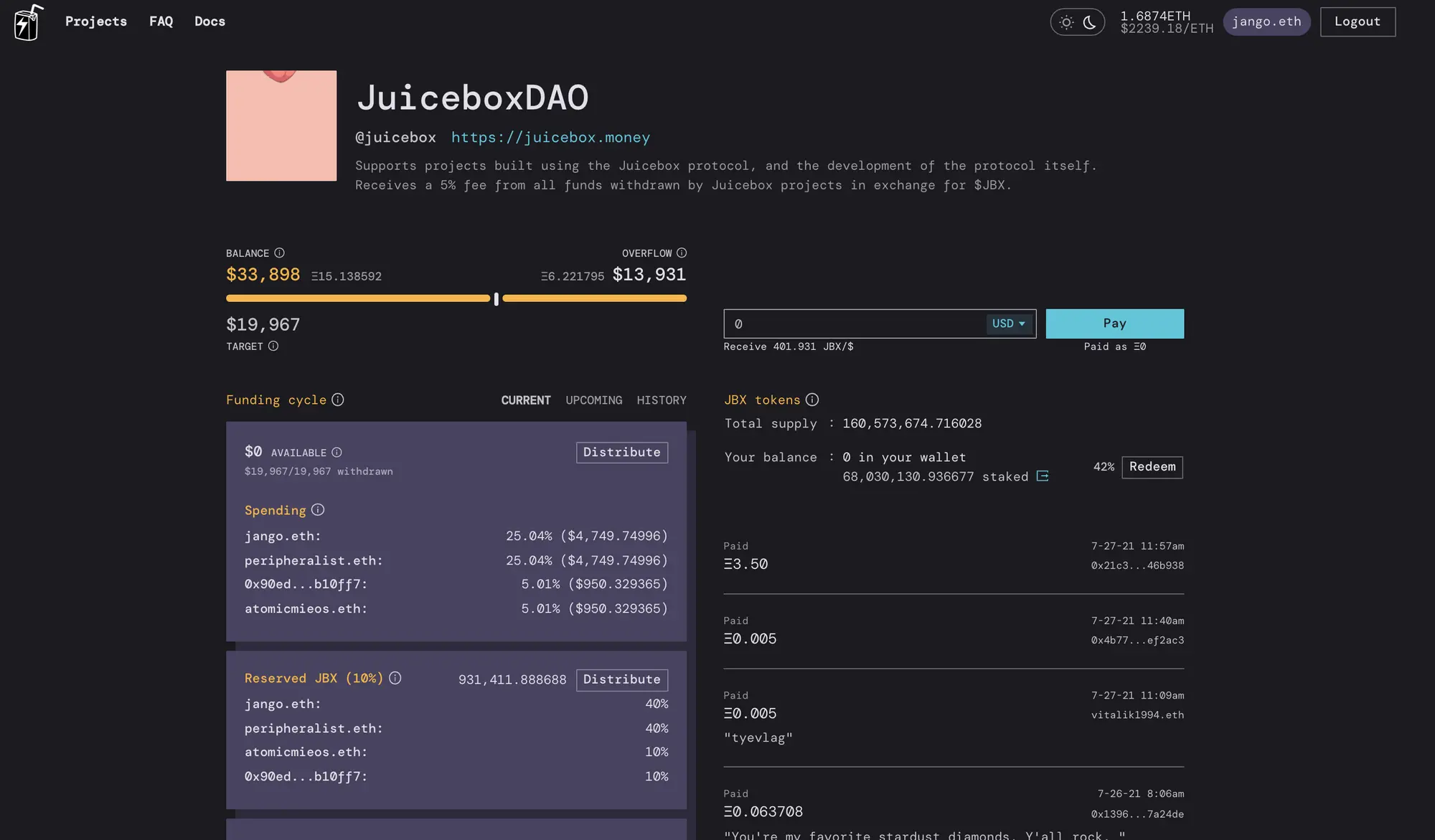

JuiceboxDAO from Jango's perspective at the time of this writing

Let's say someone parks $1 million here. My screen would then look more like this.

JuiceboxDAO from Jango's perspective at the time of this writing

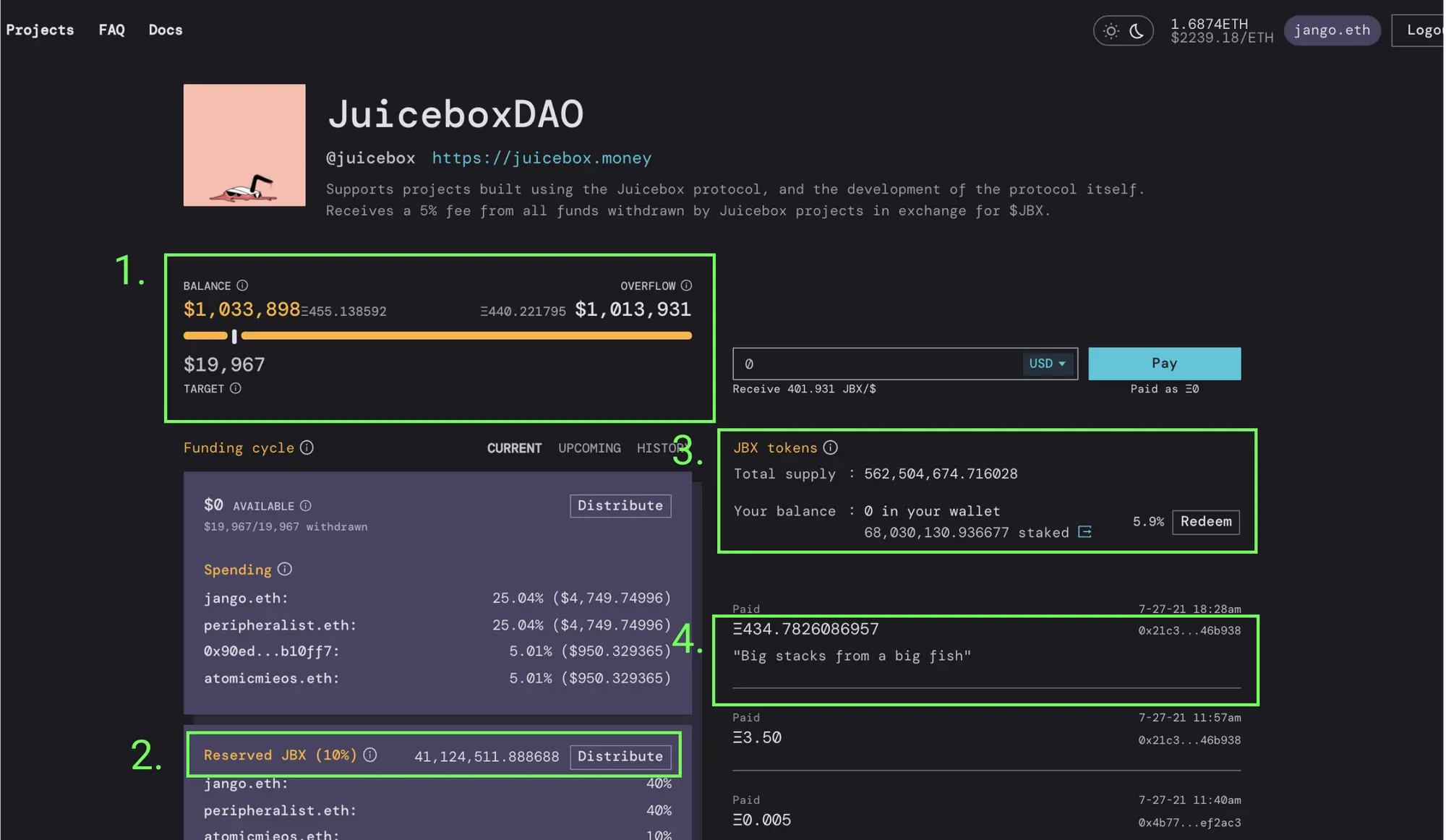

Let's say someone parks $1 million here. My screen would then look more like this.

JuiceboxDAO from Jango's perspective after a $1 million (~434 ETH) payment.

Here's what changed:

JuiceboxDAO from Jango's perspective after a $1 million (~434 ETH) payment.

Here's what changed: Screenshot from

Screenshot from