Last update: 9/07/2021

Current focus areas are:

- Risk mitigation

- Protocol upgrades

- Web experience

- Analytics

- DAO relations

- Liquidity pools

- NFT marketplace

- Governance

- Materials

Focus areas

Risk mitigation

Goal: Make sure things don't go to zero.

Current team: jango (lead), exekias, peri.

Updates:

Help needed:

- Reviewing V2 docs and tests.

- Bug bounties now included in the V2 documentation that's underway.

Protocol Updates

Goal: Evolve the protocol to be more useful.

Current team: jango (lead), peri, exekias, nicholas

Updates:

- Progress on documentation. JBSplitStore, JBOperatorStore, JBPrices, and JBProjects are fully documented. See Protocol section of docs.juicebox.money.

- Bug bounties now included in the V2 documentation

Help needed:

- More eyes on the docs

- Pursue leads for solidity audits in next 4-6 weeks

Web experience

Goal: Improve the Juicebox experience both for people starting communities and for communities that are growing.

Current team: peri (lead), jango, exekias

Updates:

- Added feature for JB Project owners to update assets listed in the Project UI

- will eventually support 721 assets, too

- 'Pay' button Call to Action can now be customized

- Rinkeby support

- JB Interface now has its own dedicated repo and issue tracking https://github.com/jbx-protocol/juice-interface

Help needed:

Analytics

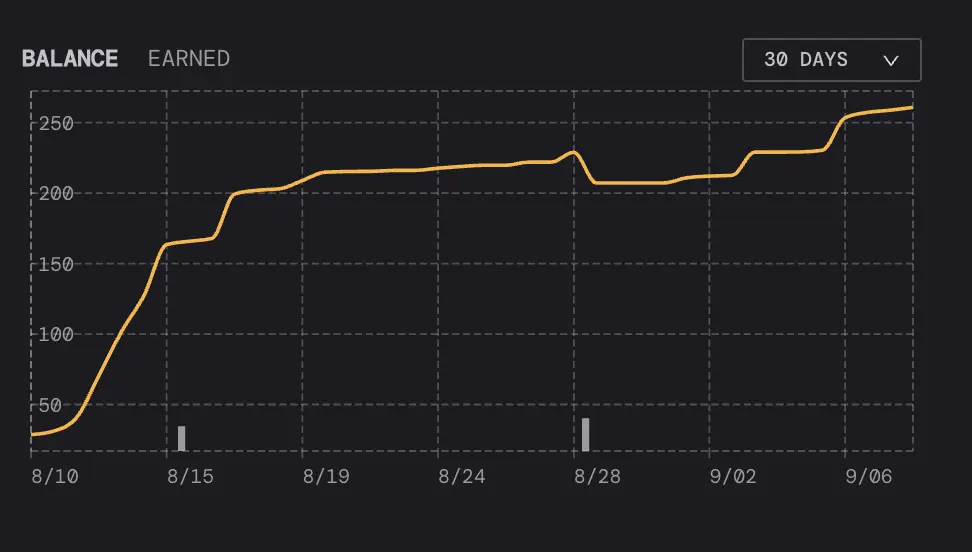

Goal: Give projects rich insights into their community treasury.

Current team: peri (lead)

Updates:

Contribution pipeline being refined. Subgraph now has a dedicated repo with a streamlined deployment flow.

Analytics roadmap being refined as steps for V2 migration become clearer.

Subgraph Deep Dive

Help needed:

DAO relations

Goal: Work towards making sure JB projects and the JB community have the resources and attention they need to get started and thrive.

Current team: nati (lead), zeugh, mieos, nicholas, jango

Updates:

- Jango and others converting people from DMs into discord members.

- Lots of people coming into the DAO relations channel.

- Pencil DAO created without any interaction with team. BrainDAO and others coming online.

- Idea: Daoification Hackathon to help JuiceboxDAO members feel more comfortable onboarding others.

- Meeting with largest single contributor: Conversation with Tom Schmidt of Dragonfly Capital

- Lots of progress in Notion: Tools section, How to section.

- Meeting notes becoming standardized and recordings much more frequent

- Gitbook docs welcome page and contract addresses added.

- Zeugh bought Sesh pro.

Help needed:

- Project lead on Daoification hackathon where anyone can join in and create a bunch of projects on rinkeby to be more comfortable configuring and reconfiguring a JB.

- Project lead needed to design and implement faster easier way to create "a DAO for your group chat". Can this be done with a Discord bot?Help Needed

- Feedback to Zeugh for discord restructuring.

- Adding info to Tools.

- More people willing to record calls and upload.

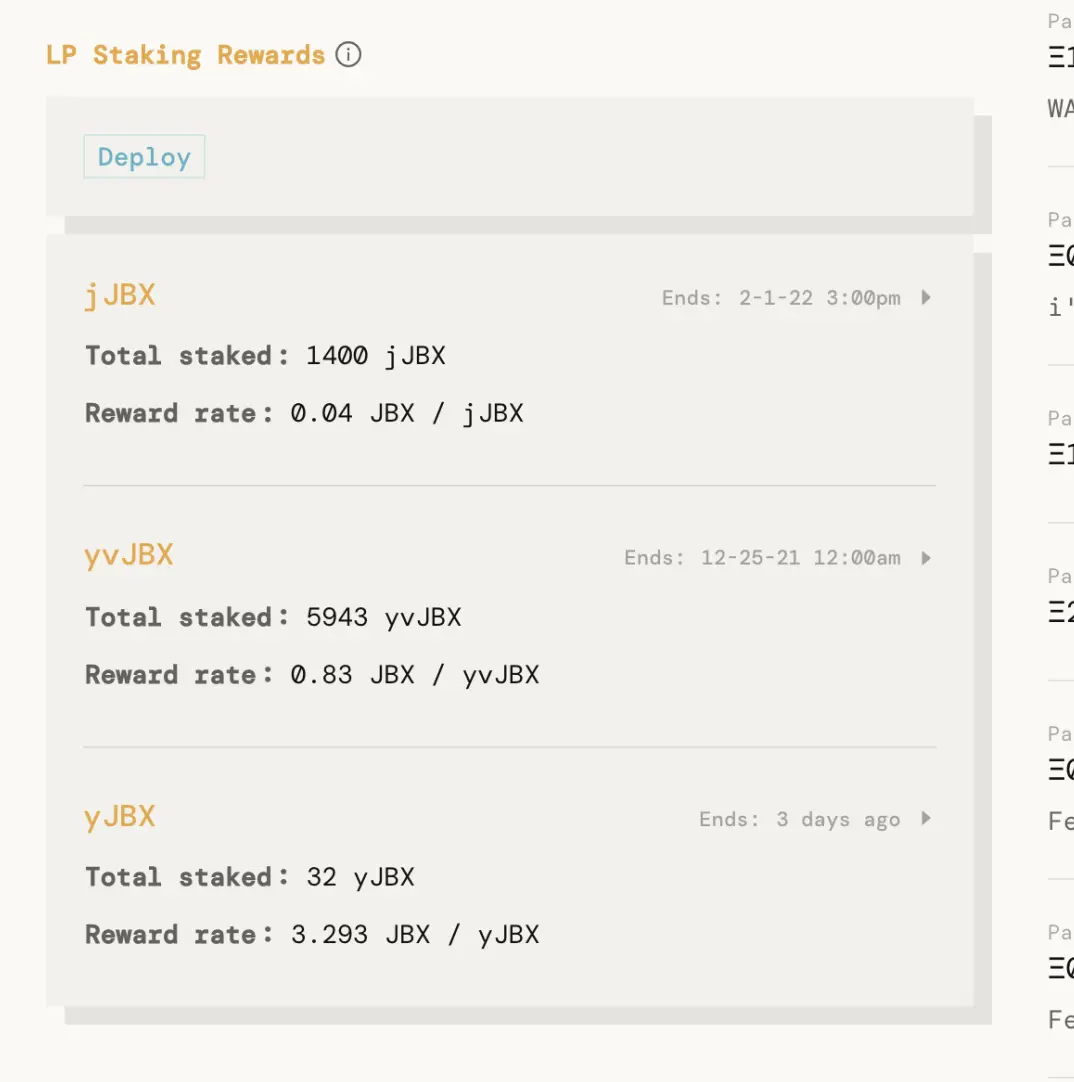

Liquidity pools

Goal: Add support for JB treasury tokens in secondary markets for communities to be able to value their assets better.

Current team: exekias (lead), jango

Updates:

- No updates. Core dev team is focusing on V2 for the time being.

- Might be a good move to fork the BarnBridge rewards contracts instead of the synthetix ones.

Help needed:

- Someone to help test, verify, and deploy the staking contracts.

NFT Marketplace

Goal: Give JB projects a place to sell digital (and eventually physical) goods which pipe percentages of revenue to any number of addresses or Juicebox treasuries.

Current team: nicholas (lead), jango, peri

Updates:

- Looped in Peri and Mieios for NFTMKT specification feedback meeting.

- Reprioritized NFTMKT, JB devs will do a sprint this coming week, Sept 27, 2021

- Nailed down V1 spec with Peri's help. Updated architecture, replacing

submit with list function, which will save on gas. - Reaffirmed permisionless design of NFTMKT and v2+ roadmap.

- We will also stand up a couple 721 Creator contracts so artists collaborating with JB projects (e.g., Numo with Sharkdao) can create superior NFTs than on the OpenSea creator contract, which is closed source, centrally hosted metadata by default, and a shared contract. We anticipate one 721 contract for closed collections (where token supply is known in advance) and one open minting collection (where artist can add over time). Nico already has a closed collection contract that we can refine. Can also build a simple front-end to make this easy for artist collaborators (and the broader NFT ecosystem).

- We continue to experiment with ideas about spinning NFTMKT off into its own JB project because the opportunity is large, and we believe that small teams working on focused projects are more effective than one overwhelmingly large vertically integrated JB protocol team. Perhaps initially staffed by same dev team as JB. Can focus on NFTMKT and the creator contracts. Could collect a fee for NFTs sold through the marketplace (2.5% like opensea?) or could be free. If it had revenue it would have more opportunity to expand dev team. Also thinking about token-swaps between NFTMKT and JB 📈🤝.

- Increasing belief that NFTMKT will solve the DEX vs JB dilemma facing DEX-traded DAO tokens, where the DEX is always a better price than the JB, by game-theoretic definition. This limits DAOs' ability to fundraise because DEX trades do not affect DAO treasuries. NFTMKT will allow DAOs like Shark to largely replace direct-to-JB appeals. DEX purchases may still offer cheaper DAO tokens than the NFTMKT, but buyers will not get access to limited edition NFTs via the DEXes. NFTMKT will also be more fun and easy to use for NFT acclimated, compared to JB or DEXes which are unfamiliar to many in that space.

- The team is very excited about the promising design specification and roadmap for the NFTMKT.

- Nicholas also discussed with Mieos affordances in the 721 contracts that will enable WAGMI to create NFTs on behalf of client DAOs. Achievable design requirements even within the V1 spec.

Help needed:

- Review read methods & TheGraph events with Exekias or Peri this coming week

- Nico x Jango will collab to finalize v1 NFTMKT solidity

- Nico to talk to Pencil DAO

Governance

Goal: Plan how we make decisions within the community.

Current team: 9birdy9 (lead), zheug, jango, unicornio

Updates:

- New voting process

- Finalized proposal process

- New governance process:

Governance

Includes Proposal Templates for each common type of proposal.

All JBX holders participate in votes that affect big picture JBX variables.

Changes to recurring payouts are voted on by addresses currently receiving payouts as they have greatest insight and are most affected by such changes.

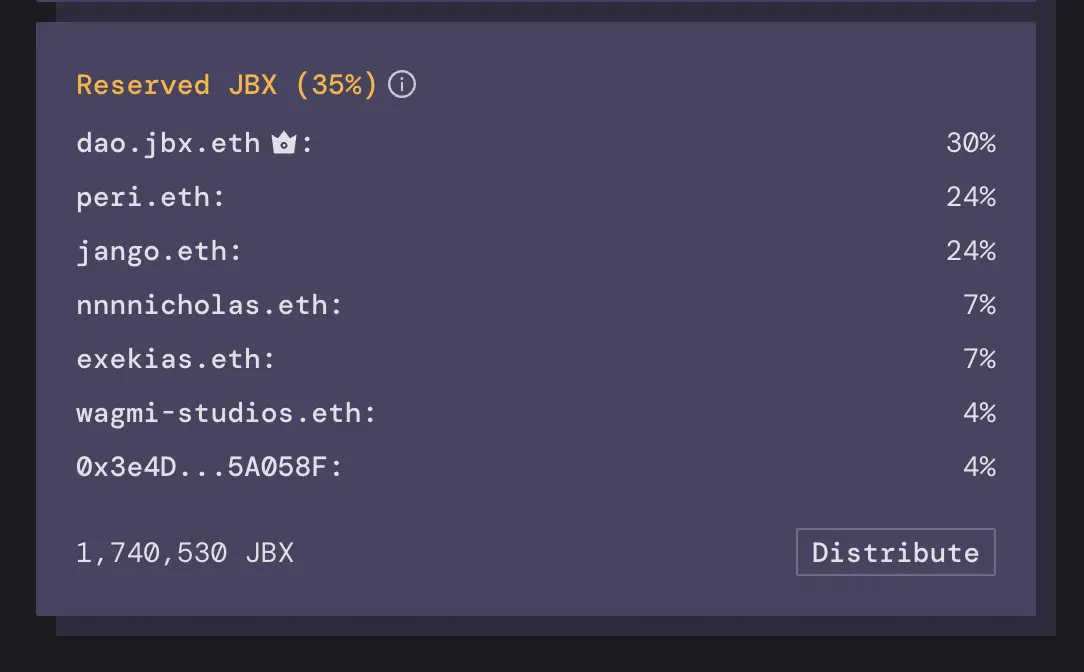

Changes to reserved token allocation voted on by addresses currently receiving reserved tokens as they are most affected.

Addresses receiving payouts are expected to vote.

- Discussion about whether large token holders and people on reserved list should have max voting capacity or some quadratic strategy that limits outsized impact.

- First trial of these new templates in current governance process.

- @9birdy9's trial payout proposal is the first proposal sent to snapshot according to these forms.

- FC5 reserved JBX tokens will be passed without a formal snapshot for lack of sufficient time to complete our governance snapshot process. We will use snapshots for future reserved token proposals.

- Creation of BANNY gov participation incentivisation token — An airdrop is in the works.

Help needed:

- Refining governance process:

- Creating informational foundations to keep people up to date on governance proposals/timelines.

Materials

Goal: Videos/visuals/memes/stuff that radiates Juicebox vibes.

Current team: WAGMI studios

Updates:

- WAGMI producing cultural content

- Published overflow video

Help needed:

- Feedback on content

- How can WAGMI help juicebox projects launch

- Helping onboard

- Developing visual identity (cultural material)

Help wanted:

Help wanted: